When Susie embarked on the challenging task of planning long-term care for both of her parents, she turned to Waterlily. Susie first learned about Waterlily through Nona's Home Care and Del Cerro Manor, a home health agency and residential care facility where both her parents have been receiving care. Thanks to the health agency’s partnership with Waterlily, Susie was given access to the platform at no cost, as the health agency and residential care facility subsidized the cost to make it free for her.

The Problem: High Care Costs and Uncertainty

Both of Susie's parents are already receiving care. Her mother, who has dementia, is in one house, while her father is in a different house to keep him safe. Being based in San Diego, the cost of care for each parent is higher than the national average, with her mother’s memory care adding further costs. Despite having significant savings set aside, the rapid depletion of these funds for their parents' care was a major concern. Susie and her family were uncertain if the savings their parents had left would last for the remainder of their care, and she feared that the family may need to eventually sell their parents' house, which would have been emotionally devastating for the family.

Building the Plan

Using the Waterlily platform, Susie entered detailed information about her parents' medical history, current health status, and personal preferences. The platform's user-friendly interface guided her through each step, ensuring she provided all necessary details.

Personalized Predictions and Cost Projections

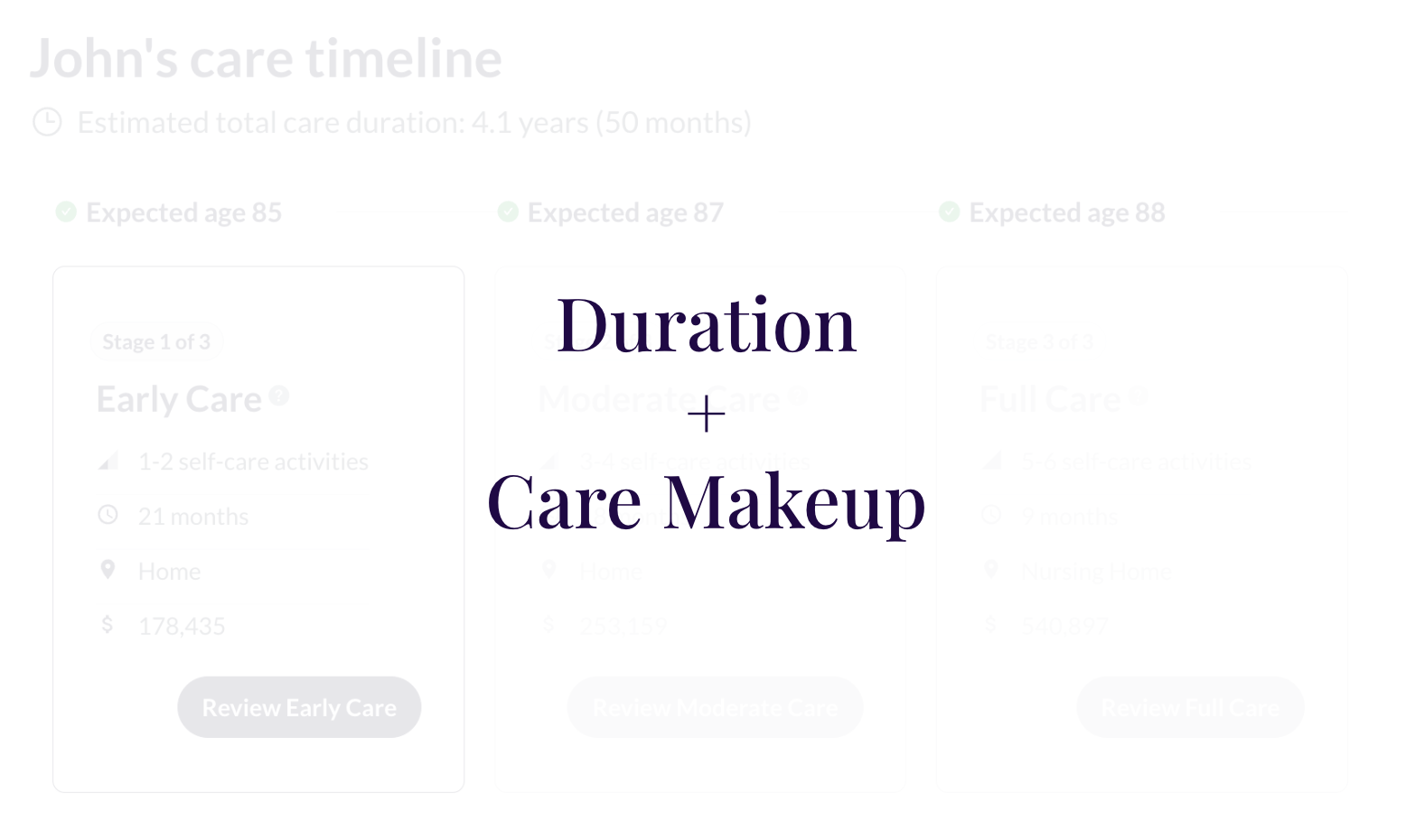

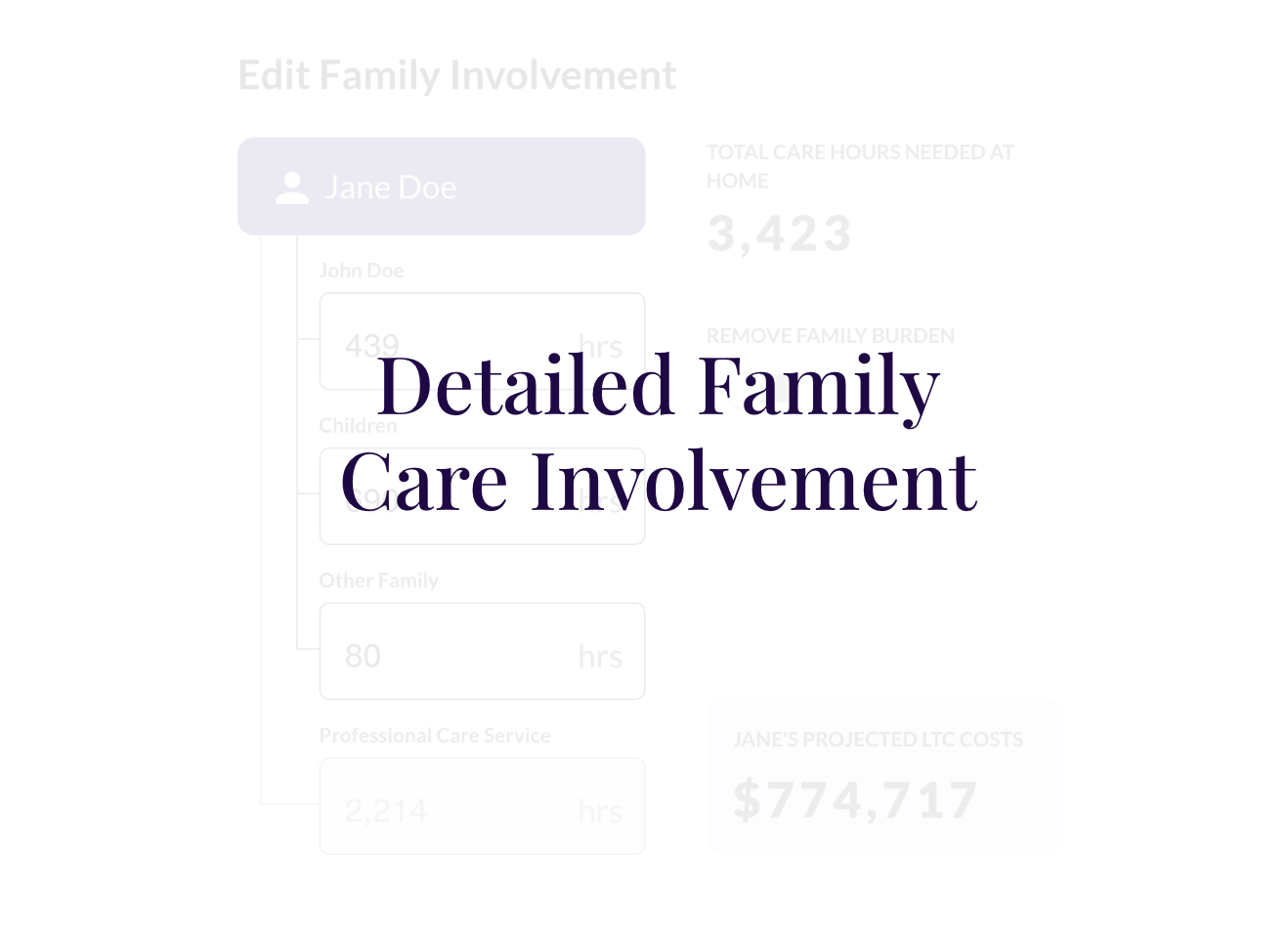

Waterlily's predictive AI generated personalized predictions for the remainder of her parents' care. By inputting the monthly care costs they were facing, Susie was able to see a personalized remaining cost prediction. This detailed financial outlook was based on their current care arrangements and localized cost factors, providing Susie with a clear understanding of the anticipated expenses.

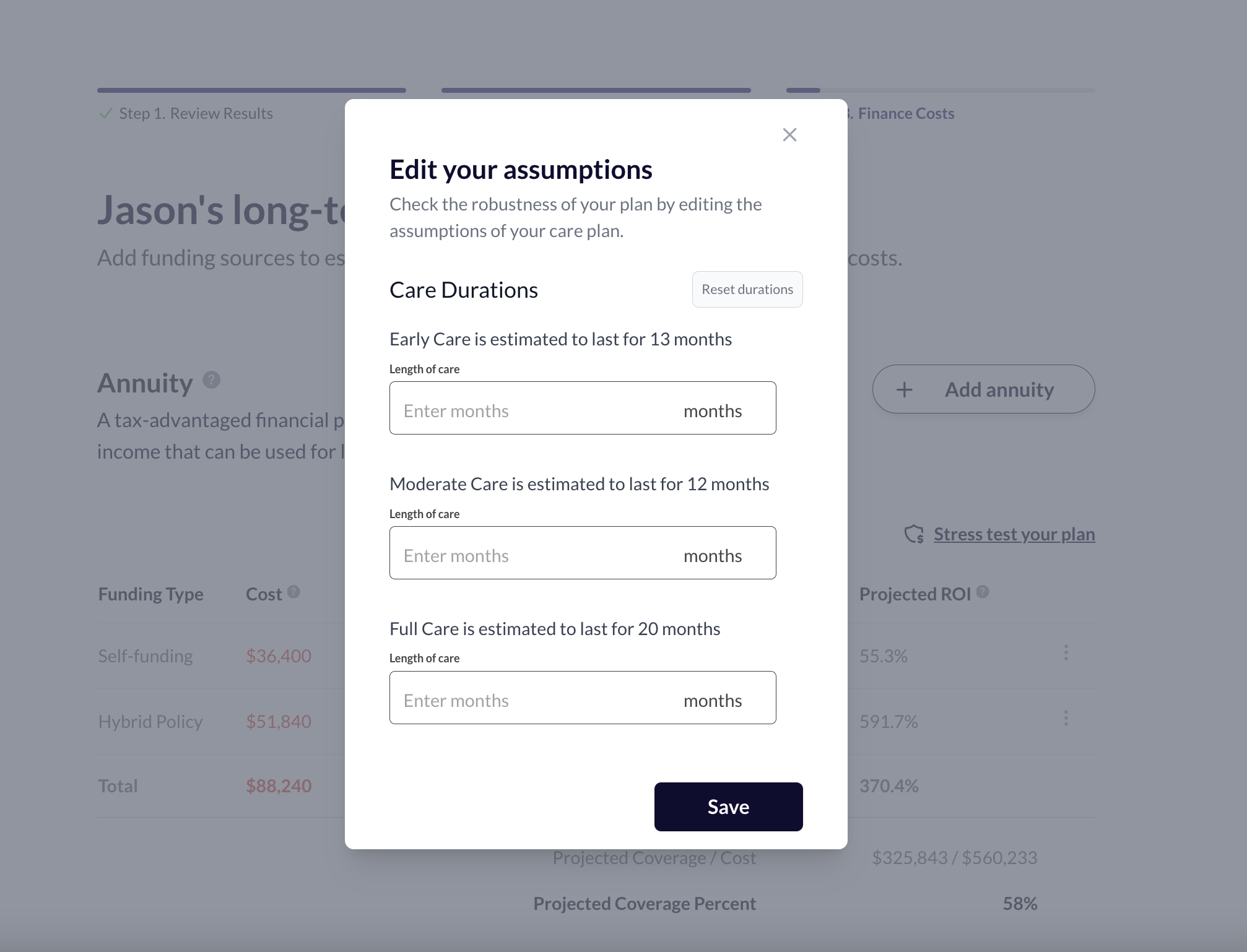

Stress Testing and Confidence Building

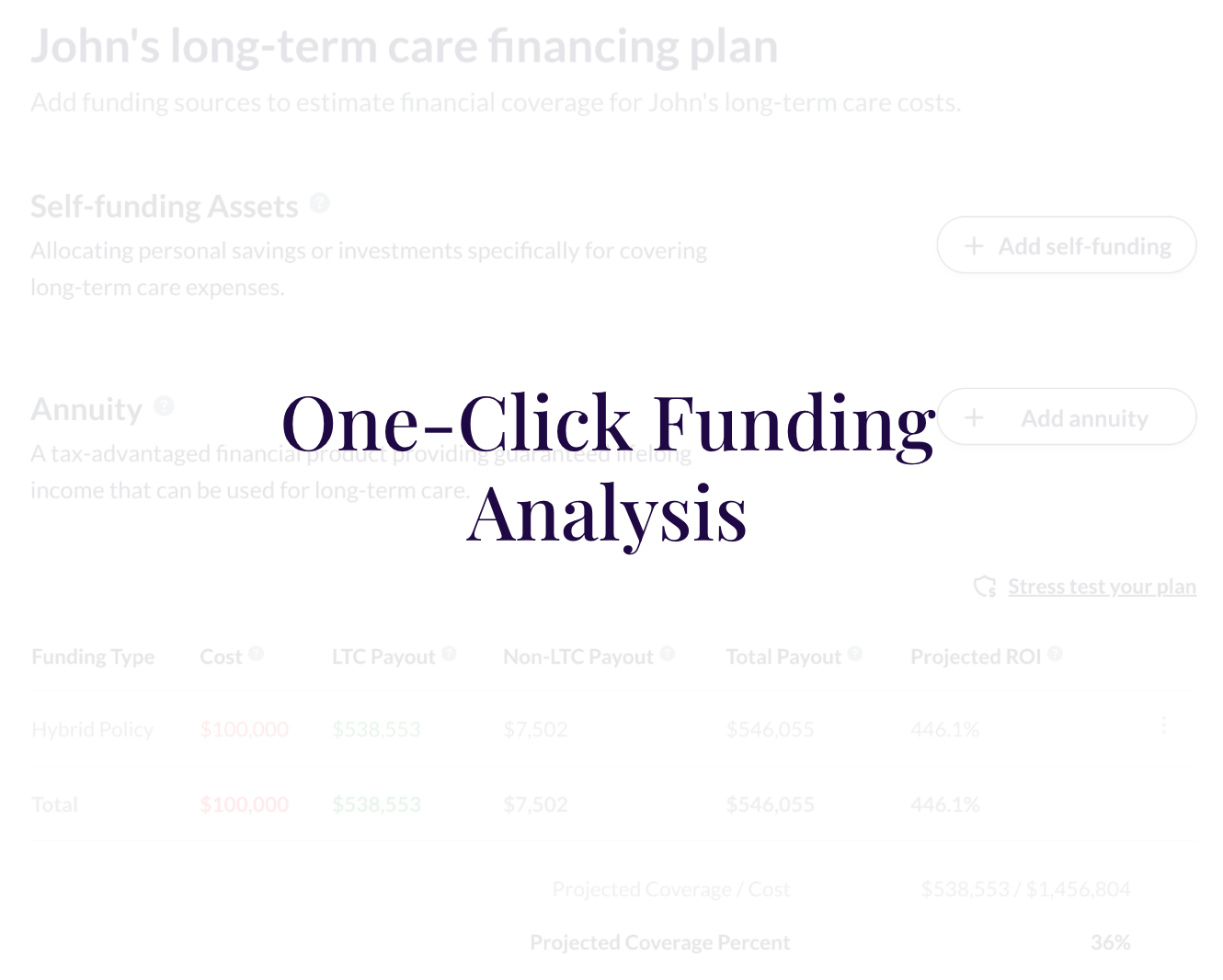

One of the standout features Susie found invaluable was Waterlily's ability to stress test the care duration and model various scenarios. This detailed analysis showed the most likely care duration for her parents. Waterlily also stress-tested their financial plan by doubling the expected remaining duration of care, and even in this extended scenario, the analysis revealed that they would not need to sell the house. This significantly reduced Susie's concerns and provided her with much-needed peace of mind.

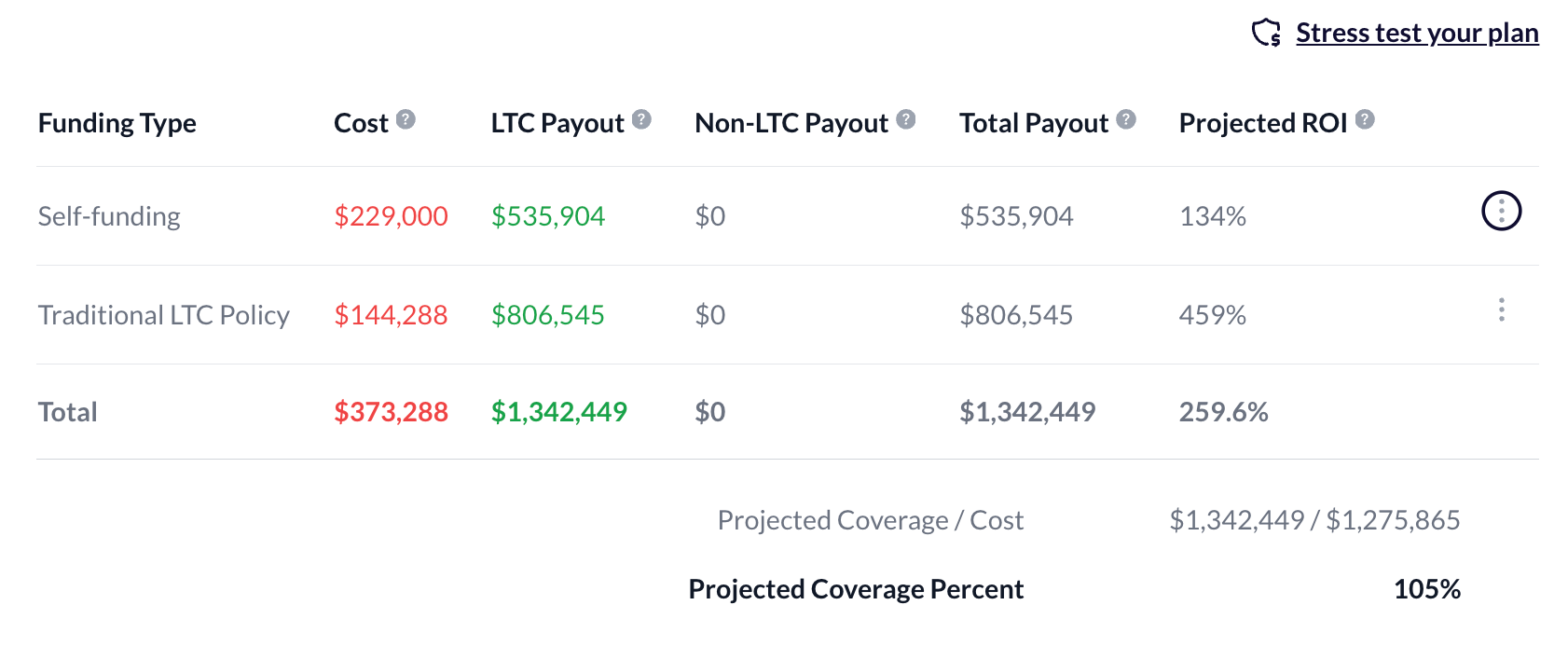

Rediscovering the Value of a Terminated LTC Policy

Waterlily also helped Susie revisit a previous long-term care policy that her parents had but stopped paying into. The platform's analysis made it clear that the LTC policy would have had a much higher ROI than the self-funding assets they were currently using. Susie realized that if they had continued paying into the policy, it would have provided substantial financial benefits and coverage. She recognized that having access to Waterlily earlier would have clearly shown the value of maintaining the policy, potentially preserving its benefits for their long-term care needs by preventing the policy cancellation in the first place.

Positive Impact on Decision Making

Armed with Waterlily’s detailed insights and stress-tested scenarios, Susie felt more confident in her decisions. She was able to have informed discussions with her family about the best course of action for her parents' remaining care. This newfound clarity not only alleviated much of the stress associated with long-term care planning but also ensured her parents' needs would be met in the most efficient way possible.

Feedback and Continuous Improvement

Susie shared her positive experience with Waterlily’s team, highlighting how the platform made a complex process manageable and less intimidating. Her feedback contributed to ongoing improvements, ensuring even better support for future users.

Conclusion

Waterlily’s advanced predictive analytics and user-friendly interface proved invaluable for Susie in planning her parents' long-term care. By providing personalized predictions, accurate cost projections, facilitating comprehensive financial planning, and stress testing care scenarios, Waterlily empowered Susie to make well-informed decisions, ensuring her parents' current and future care needs would be met with confidence and clarity. Susie only wishes her family had discovered Waterlily earlier, as it could have shown her parents the value of maintaining their long-term care policy, ultimately providing an even better financial outcome.