Adam Vega, CFP®, a financial advisor at Avance Private Wealth Management, is dedicated to providing high-net-worth clients with personalized financial strategies. When faced with the challenge of optimizing long-term care (LTC) planning for his clients, Adam turned to Waterlily’s advanced predictive analytics to enhance his approach.

One of Adam’s clients, a woman in her late 60s from North Carolina, had a significant amount of her assets tied up in an annuity purchased years ago for $100,000, now valued at $350,000. The client intended this annuity to be part of her legacy for her daughter. Given the current high-interest-rate environment, Adam recognized an opportunity to improve her financial strategy with a new annuity that offered a better outcome.

Before starting the conversation around new annuities, Adam had the client fill out Waterlily’s 3 minute intake form to predict her future long-term care needs.

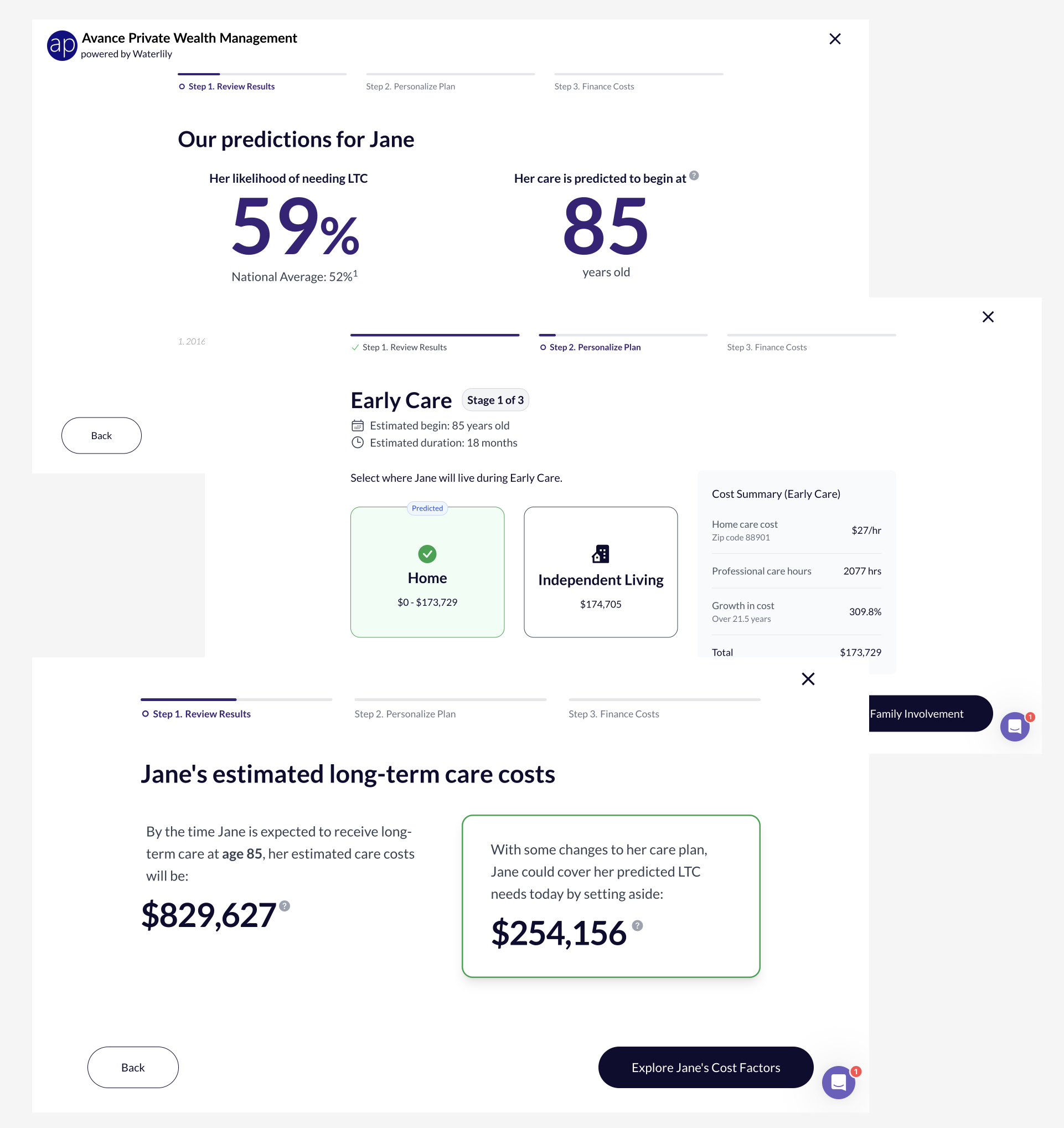

With the output revealing the likelihood, timing, and duration of a potential future long-term care event, Adam was able to walk the client through a conversation not just about ROI, but also about protecting her daughter that the annuity was originally purchased for.

By including a long-term care component to the annuity, Adam and his client were able to see how the additional payout, specific to the client’s predicted future long-term care needs, would not only drive a higher ROI compared to annuities without the feature, but it would also help afford the professional care that the client would need, safeguarding her daughter from having to step in as a family caregiver later in life.

While the client would likely have purchased a new annuity simply due to today’s higher rates, Waterlily enhanced the conversation by providing a comprehensive view of her potential LTC costs and timelines. This enabled Adam to demonstrate the added value of selecting an annuity with an LTC component. The new product offered the client an annual income which could double if she required LTC. This feature provided substantial coverage without depleting her other assets, ensuring her wealth would be preserved for her daughter while also addressing her own future care needs and protecting her daughter.

Waterlily’s analysis highlighted how the LTC component of the new annuity would offer a stronger return on investment (ROI). By showing detailed projections of the client’s future LTC needs, Waterlily clarified the necessity of the LTC benefits and demonstrated the higher ROI that the new annuity could provide. This clarity helped the client understand the added value and solidified her decision to select the annuity with the LTC component.

Adam has successfully used Waterlily’s predictive analytics with several clients, each benefiting from the platform’s ability to provide a clear picture of future LTC needs. By consistently incorporating Waterlily’s insights into his advisory process, Adam has been able to guide clients toward annuities that not only offer better returns in a high-interest-rate environment but also include LTC components that provide additional security and peace of mind.

For instance, another client, also in her late 60s, held an annuity earning a modest 4% annually. Given the current high-interest-rate environment, Adam saw a prime opportunity to improve her financial strategy. The client was interested in maximizing her retirement income and securing funds for potential LTC expenses. Waterlily’s comprehensive analysis of her future LTC needs prompted a conversation about reallocating her annuity to a new one with a higher return rate of 7-8%. This shift not only increased her annual income but also included a provision to double her income if she needed LTC in the future.

By demonstrating the value of the LTC component through Waterlily’s projections, Adam was able to ensure that the new annuity was tailored to meet the specific needs of each of these clients. This approach has proven effective in multiple cases, making the decision to purchase annuities with LTC components easier for clients and setting them up for better long-term success.

Waterlily has significantly enhanced Adam’s ability to advise clients on LTC planning. The platform’s detailed predictions and user-friendly interface enable Adam to provide personalized, data-driven insights that resonate with his clients.

We've been having these conversations, they understand that everything's just getting more expensive. And why not allow us to come up with a mechanism to help pay for some of it.

Adam Vega, CFP®, Avance Private Wealth Management

By using Waterlily, Adam can engage clients in meaningful discussions about their future care needs, helping them make informed decisions about their financial strategies. This approach not only boosts client confidence but also strengthens the advisor-client relationship by demonstrating a commitment to their long-term well-being.

About Adam Vega

Adam Vega is a dedicated financial advisor at AVANCE Private Wealth Management, specializing in helping high-net-worth individuals make informed financial decisions. With a focus on financial comprehension and education, Adam empowers clients to secure their financial futures, preserve wealth, and achieve their long-term goals. His client-centric approach and deep understanding of financial strategies make him a trusted advisor in the industry.

Company Information:

At Avance Private Wealth Management, we understand that choosing a financial firm is a significant decision. As a fee-only fiduciary firm, we prioritize our clients' best interests, providing unbiased and comprehensive financial advice. Our expertise in navigating complex financial matters and our commitment to personalized service set us apart. We believe in strategic planning and proactive management to help our clients overcome challenges and achieve their financial aspirations. Contact us to explore how we can help you secure your financial future.