When Insight Financial Strategists’ Chris Chen, CFP®, a fee-only certified financial planner from Newton, MA, sought to enhance his approach to the complexities of long-term care (LTC) planning for his clients, he discovered an invaluable ally in Waterlily.

Chris has had many LTC conversations with his clients, but a particular couple in their early 50s, Nancy and Dwight, were especially anxious about the potential future costs of LTC—a common concern for many as they approach retirement.

Planning for LTC can be a vexing endeavor. It is notoriously expensive. Most of us will need it, but a significant percentage will not. The cost can vary across wide ranges. In any case, ignoring LTC may result in unpleasant surprises. Yet until Waterlily, there was not a noteworthy analytical method to evaluate the cost of LTC for financial planning clients.

- Chris Chen, CFP®, Insight Financial Strategists

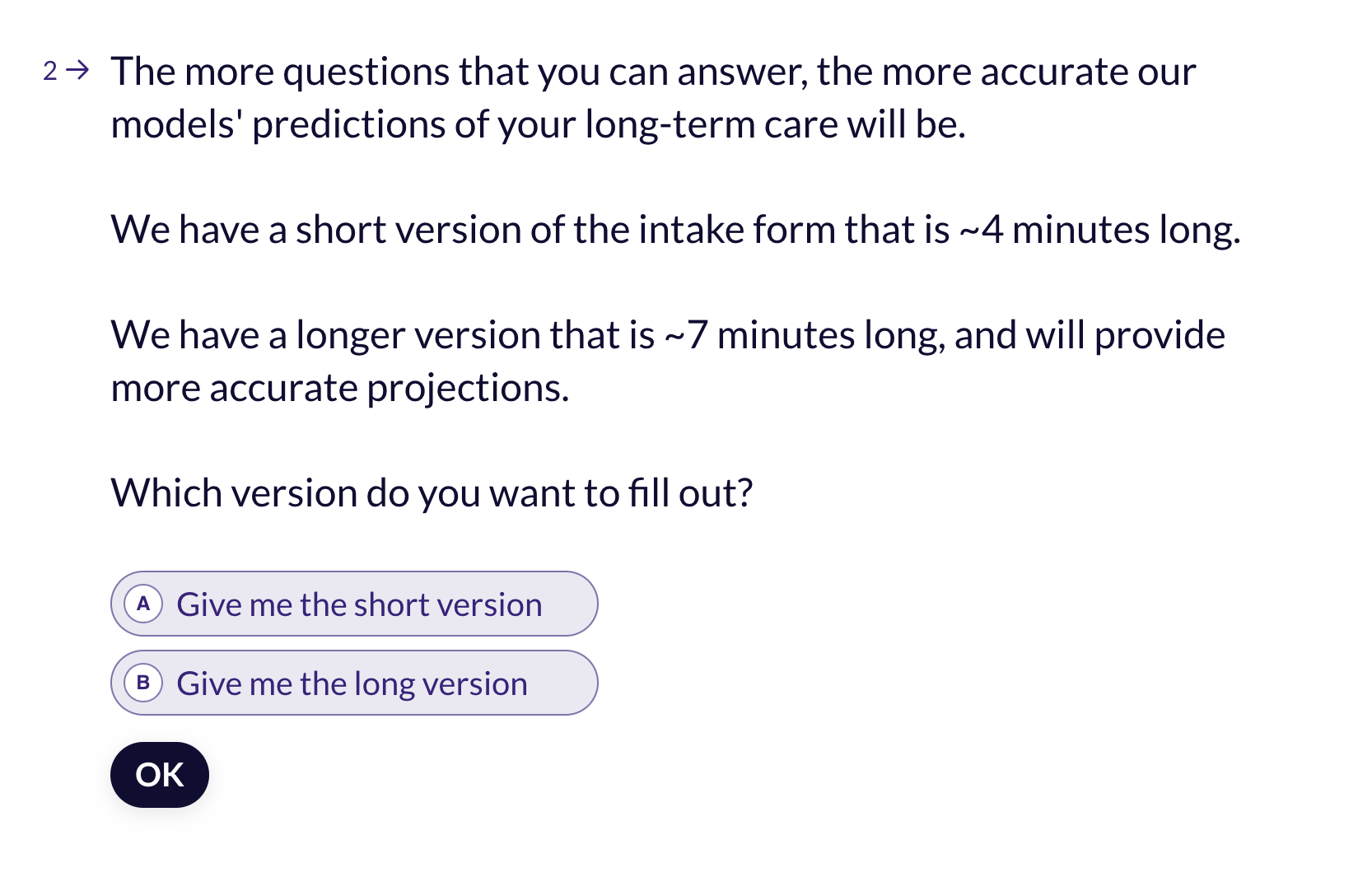

Chris turned to Waterlily to provide a comprehensive and personalized analysis of the couple's future long-term care needs. In a matter of minutes, Chris entered his clients' medical, demographic, financial, and family history data into the platform.

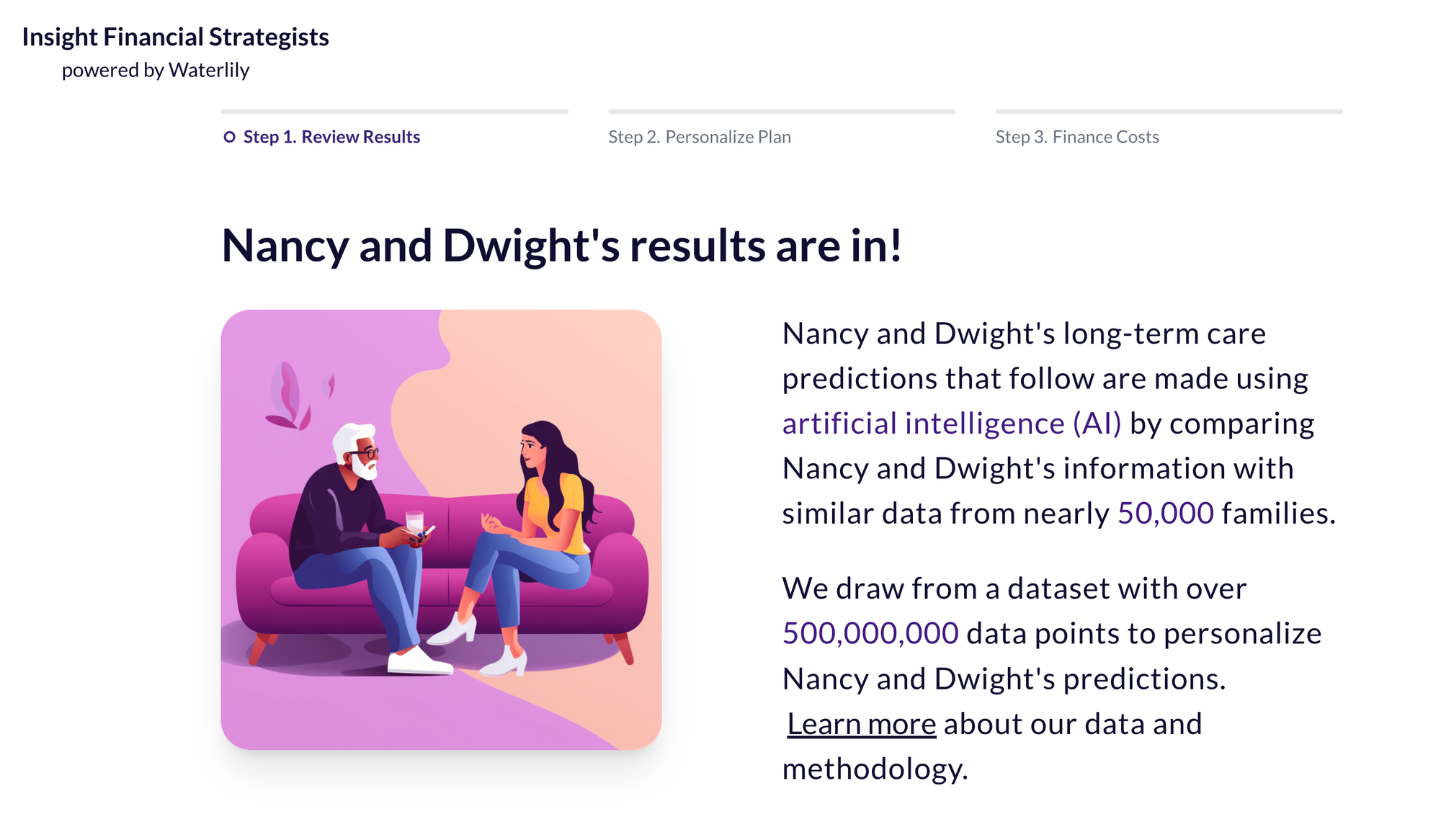

Waterlily’s AI, with over 20 years of data from nearly 50,000 families, generated detailed predictions about their long-term care requirements.

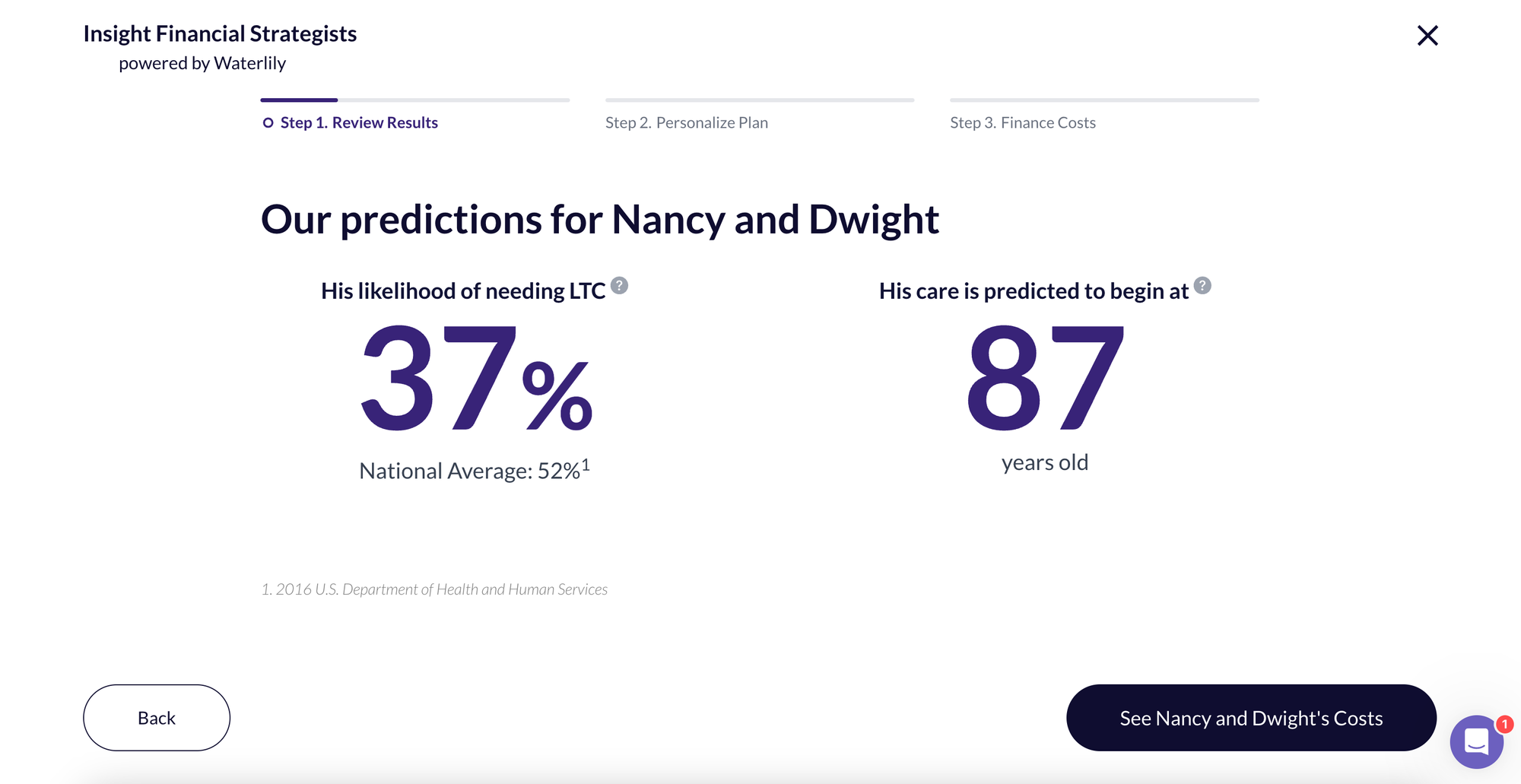

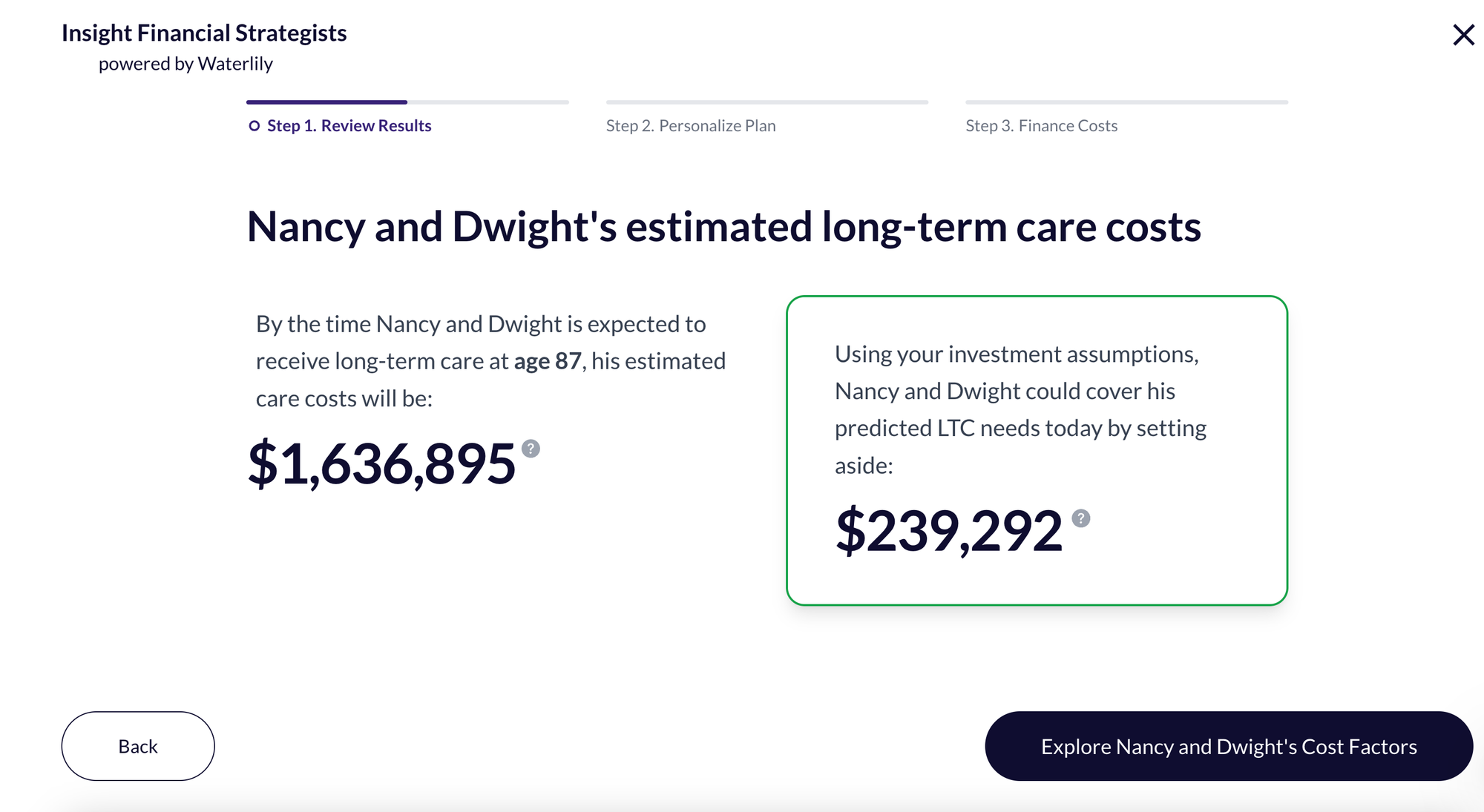

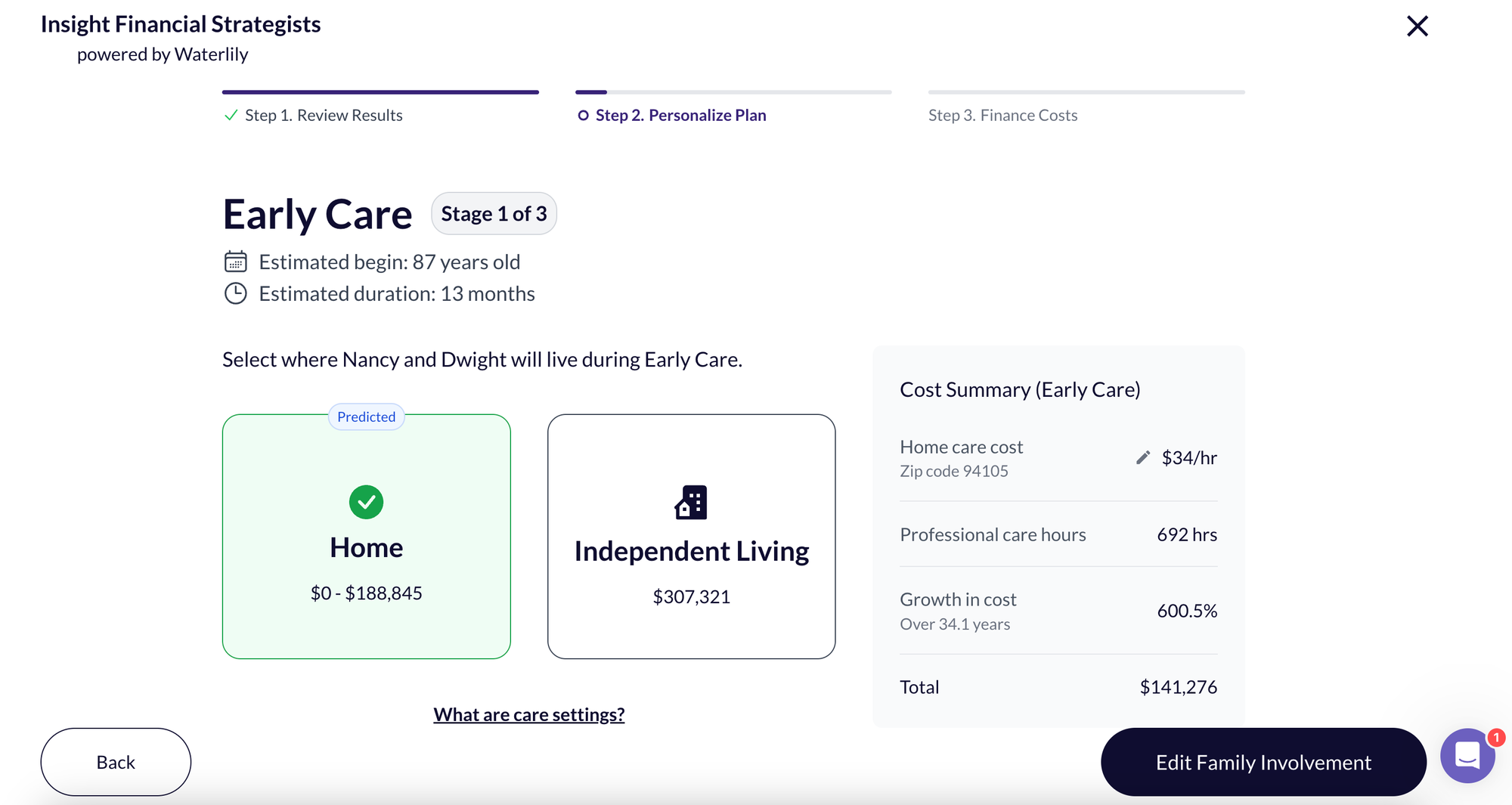

Armed with these predictions, Chris was able to facilitate a guided conversation tailored to Dwight's and Nancy's specific circumstances. The data-driven insights from Waterlily included the likelihood of needing LTC, the most probable start age, and the progression timeline of their care needs. This personalized information was instrumental in addressing the couple's concerns and helping them understand and plan for the potential costs associated with various LTC scenarios.

Examples of the types of predictions that Waterlily made for Nancy and Dwight. This does not make use of their actual data, and is for illustrative purposes only.

Chris used Waterlily to model different LTC insurance options, including hybrid policies and self-funding strategies. The platform provided a holistic view of Nancy's and Dwight's future LTC needs, care plan, and financial positioning. By integrating Waterlily’s outputs with his financial planning tools, Chris was able to stress-test different scenarios and provide a clear, quantitative basis for his clients' decisions.

One of the key benefits highlighted by Chris was the platform’s impact on client confidence. The ability to visualize and quantify LTC costs, which had previously been a significant source of stress, provided Nancy and Dwight with much-needed reassurance in the face of a morbid topic. Nancy and Dwight appreciated the clarity Waterlily brought to their planning process, which enabled them to make informed decisions about their financial future with greater confidence.

Moreover, the interactive use of Waterlily during client meetings enhanced the engagement and trust between Chris and Nancy and Dwight. Chris shared how the platform's modern, user-friendly interface and detailed predictions made it easier for Nancy and Dwight to understand the implications of their choices and feel more involved in their financial planning.

For financial advisors considering Waterlily, Chris’s experience demonstrates how the platform can transform a complex aspect of financial planning into a clear, manageable, and data-driven process. For Chris and his clients, the platform not only provided valuable insights and peace of mind but also strengthened their advisor-client relationship through thoughtful and personalized long-term care planning.

About Chris Chen

Chris Chen, CFP® is a Newton, MA area fee-only certified financial planner serving clients across the country. Insight Financial Strategists provides financial planning, retirement planning, investment management, and divorce planning services. As a fiduciary and independent financial advisor, Chris is committed to providing unbiased and trustworthy financial advice. His approach helps clients achieve their long-term financial goals through wealth preservation, retirement income planning, and legacy planning. Chris's extensive experience in strategic business management enables him to offer unique and effective financial strategies to his clients.